north dakota sales tax on vehicles

The sales tax rate for North Dakota is 5 percent plus the applicable rate for local jurisdictions. Ad Auto Sales Tax information registration support.

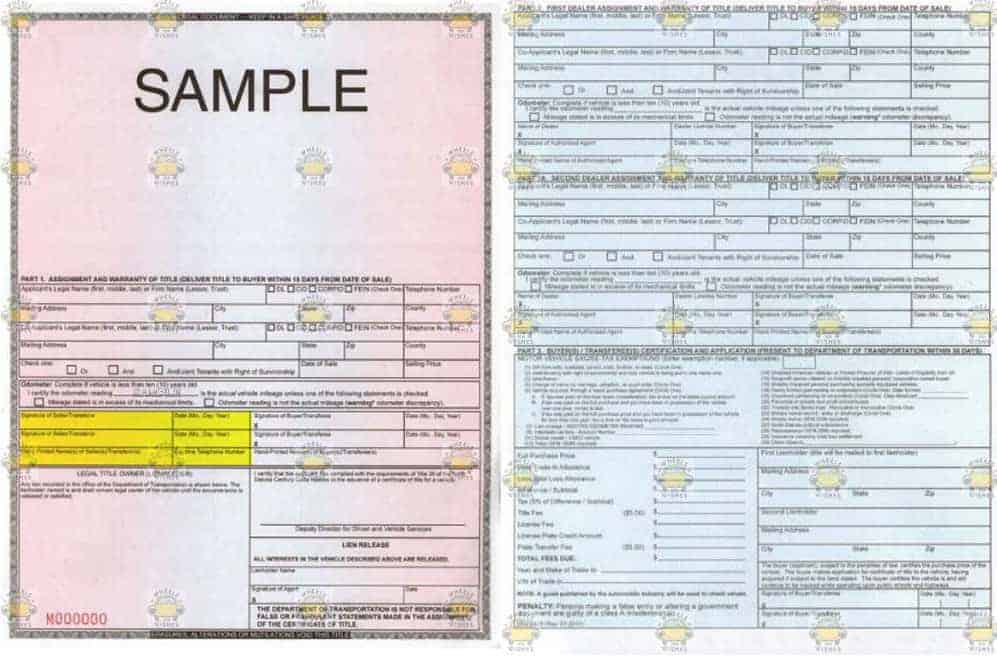

Pin On Form Sd Vehicle Title Transfer

Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction.

. Motor Vehicle Fuel Tax Gasoline and Gasohol A motor vehicle fuel tax of 023 cents per gallon is imposed on motor vehicle fuel sold to retailers and consumers. North Dakota has a 5 statewide sales tax rate but also has 214 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 096 on top of the state tax. Ad Download Or Email ND Form ST More Fillable Forms Register and Subscribe Now.

Gross receipts tax is applied to sales of. What is the sales tax on a car in North Dakota. Sales of fossil fuel-powered cars will be banned by 2030 and electric vehicles promoted with tax breaks and by.

I recently registered my vehicle in North Dakota and then moved out of state. Additionally the state reduces the tax rate for business taxpayers purchasing new farm machinery for exclusive agricultural use to 3 percent and new mobile homes to 3 percent. North Dakota sales tax is comprised of 2 parts.

North Dakota Resident 30 Day Temporary Registration Make online payments using credit or debit card. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The 5 sales tax and the 3 rental surcharge are separate charges with each applying to the rental charges and are in addition to motor vehicle excise tax paid on the vehicle purchase price.

Although North Dakotas regular sales tax can range from 475 up to 85 if youre buying a car a flat 5 sales tax is always applied. Some taxpayers may qualify for a refund on motor vehicle fuel tax. Overview of North Dakota Taxes The average effective.

Do South Dakota vehicle taxes apply to trade-ins and rebates. How are trade-ins taxed. This means that depending on your location within North Dakota the total tax you pay can be significantly higher than the 5 state sales tax.

The sales of licensed motor vehicles including trailers and semi-trailers are subject to a motor vehicle excise tax instead of state and local sales taxes. Simplify the sales tax registration process with help from Avalara. New State Sales Tax Registration.

The rate of penalty applied to delinquent sales tax returns was changed to. IRS Trucking Tax Center. Motor vehicle fuel includes gasoline and gasohol.

The motor vehicle excise tax is in addition to any other tax provided for by law on the purchase price of motor vehicles. Cities and counties may levy sales and use taxes as well as special taxes such as lodging taxes lodging and restaurant taxes and motor vehicle rental taxes. Be sure the seller has signed dated and completed Part 1 including the odometer reading if the car is less than 10 years old.

The average local tax rate in North Dakota is 0959 which brings the total average rate to 5959. However this does not include any potential local or county taxes. BEIJING AP Hainan island in the South China Sea says it will become Chinas first region to ban sales of gasoline- and diesel-powered cars to curb climate-changing carbon emissions.

The motor vehicle excise tax is in addition to motor vehicle. Sales tax was imposed on all vehicle rentals of less than 30 days at a rate of 5 and an additional 3 surcharge was imposed on vehicles weighing less than ten thousand pounds. The following credit and debit cards are accepted.

The North Dakota 5 sales tax and 3 rental surcharge are imposed on rentals of motor vehicles for periods less than 30 days in this state. How much is property tax in North Dakota. Aug 24 2022 1257 AM CDT.

All payment charges will be in US dollars. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. License fees are based on the year and weight of the vehicle.

Updates are posted 60 days prior to the changes becoming effective. Title transfer fee is 5. The 5 percent sales tax and the 3 percent rental surcharge are separate charges with each applying to the rental charges.

How are car trade-ins taxed in North Dakota. The state sales tax on a car purchase in North Dakota is 5. The North Dakota 5 percent sales tax and 3 percent rental surcharge are imposed on rentals of motor vehicle for periods less than 30 daysin this state.

Vehicle Registration Renewal Options 2290 IRS Filing Requirements NOTE. The use tax works in conjunction with the sales tax. The motor vehicle excise tax must be paid to the North Dakota department of transportations motor vehicle division when application is made for registration plates or for a certificate of title for a motor vehicle.

The motor vehicle excise tax is 5 of the purchase price the sales price less any trade-in amount or if the vehicle is acquired by means other than purchase the tax is 5 of the fair market value. This system will provide online motor vehicle fee calculations to determine registration fees and credits as well as tax and other fees. Vehicles required to be registered in North Dakota must pay a motor vehicle excise tax on the purchase price sales price less any trade-in amount or on the fair market value of the.

In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees. New local taxes and changes to existing local taxes become effective on the first day of a calendar quarter. NORTH DAKOTA SALES TAX 5 County Tax - Yes Personal Property Tax No 701 328-7088 or 877 328-7088 REGISTRATIONS Documented Boats are Not Required to Be.

Apportioned vehicles can not be calculated by this system. All fees will be recalculated by the Motor Vehicle Division and are subject to change. Alcohol at 7 New farm machinery used exclusively for agriculture production at 3 New mobile homes at 3.

When you buy a car in North Dakota be sure to apply for a new registration within 5 days. Please contact 844-545-5640 for an appointment. You can find these fees further down on the page.

The statewide sales tax in North Dakota is 5 and that rate applies to any vehicle purchased anywhere in the state. Any motor vehicle excise use or sales tax paid at the time of purchase will be credited. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to North Dakota local counties cities and special taxation districts.

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. You will also need to pay a 5 title transfer fee 5 sales tax and registration fees based on the vehicles age and weight. In North Dakota there are 3 types of motor fuel tax.

What S The Car Sales Tax In Each State Find The Best Car Price

North Dakota Vehicle Title Donation Questions

Minot State University Approved Logo State University University Minot

Infiniti Qx80 Lease Deals Incentives Special Offers Lease Deals Infiniti Usa Infiniti

What To Do After A Hit And Run In South Dakota Bankrate

سوق السيارات بجدة Http Www Jeddah Properties Com Forums Jeddah Cars Market Suv Vehicles Suv Car

Free North Dakota Motor Vehicle Dmv Bill Of Sale Form Pdf

North Dakota Vehicle Donation Title Questions Vehicles For Veterans

North Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

2009 Ford Edge For Sale In Frankfort Il Offerup

North Dakota State Vehicle Title Transfer Guide Sell My Car Now

Car Sales Tax In North Dakota Getjerry Com

North Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

South Dakota Ev Fast Charging Plan South Dakota Department Of Transportation

Lakota Country Times Oglala Lakota County Gets Police Vehicles Native American News Native American Indians Country Time

Nj Car Sales Tax Everything You Need To Know

Subaru 360 Taxi Owned By M Kindelberger Subaru Subaru Cars Subaru Tribeca